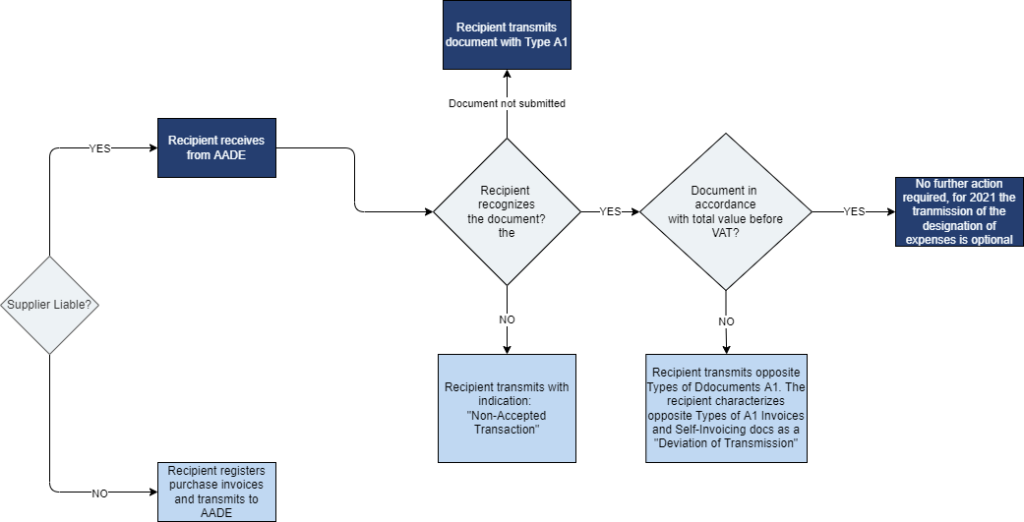

In text below we will try to simplify and explain the flows related to the submission of expenses on a case-by-case basis. For even deeper comprehension, we have moved on to a visualization of the process that will help you understand the procedure clearly.

Flow 1: The supplier is non-liable (based abroad, credit institutions, public utilities, etc.)

The recipient submits the expenditure documents in accordance with the same procedure as in the case of revenue. In other words, he registers the purchase invoice in his ERP and transmits it to AADE.

Flow 2: The supplier is liable (domestic based supplier who transmits his revenues to AADE)

In this flow, the recipient initially receives the documents that the suppliers have forwarded for his VAT number, from AADE.

Case 1: The total value (before adding VAT) is correct.

The recipient does not need to do anything additional, as for 2021 the transmission of the designation of expenses is optional.

Case 2: The supplier has not forwarded the document

The recipient must transmit the document with Document Type A1 (Omission of Transmission [Recipient]), transmit the corresponding characterizations of transactions a) invoicing costs and self-invoicing revenues b) approximate VAT classifications and c) potentially E3 designations.

There is no obligation to transmit, per counterparty issuer, if the total value before VAT does not exceed one hundred (100) euros per company’s registration number of the counterparty and per tax year.

If the issuer has transmitted his data for year 2021, in accordance with the alternative mode of transmission, in aggregate per recipient and per month, the Recipient shall transmit the cases of failure to transmit by means of the procedure of deviation of transmission only in summation.

Case 3: The recipient does not recognize the specific document

In case the recipient does not accept a document, he transmits it with the indication “Non-Accepted Transaction”

Case 4: The supplier has forwarded the relevant documents, but the recipient considers that there is a incompatibility in the amounts

The deviation must be more than (100) euros in the total value before VAT for all the supplier’s documents for 2021

In this case of deviation of transmission, exceptionally for the year 2021, the recipient transmits exclusively opposite Types of Documents A1. In particular, the recipient may characterize the opposite Types of A1 Invoicing and Self-Invoicing Documents of the Issuer as a “Deviation of Transmission” and these data do not affect its accounting and tax result.

Followingly he must forward the documents that he considers having a deviation with Type of Documents A1 (Deviation of Transmission [Recipient]) and forward the corresponding characterizations of transactions a) invoicing costs and self-invoicing revenues b) approximate VAT classifications and c) potentially E3 designations.

For 2021, the transmission deviation data are always transmitted in aggregate per TIN of the counterparty issuer.

More details can be found in the announcement of AADE as follows:

https://www.aade.gr/sites/default/files/2022-07/paralipsi_apoklisi_diavdedom_myDATA_2021.pdf